Our Approach

Our vision is of a Regenerative Economy where people can thrive while respecting social and planetary boundaries

WHY ?

The Linear Economy and fossil fuel-based consumption are largely linked to global warming and several other significant negative impacts.

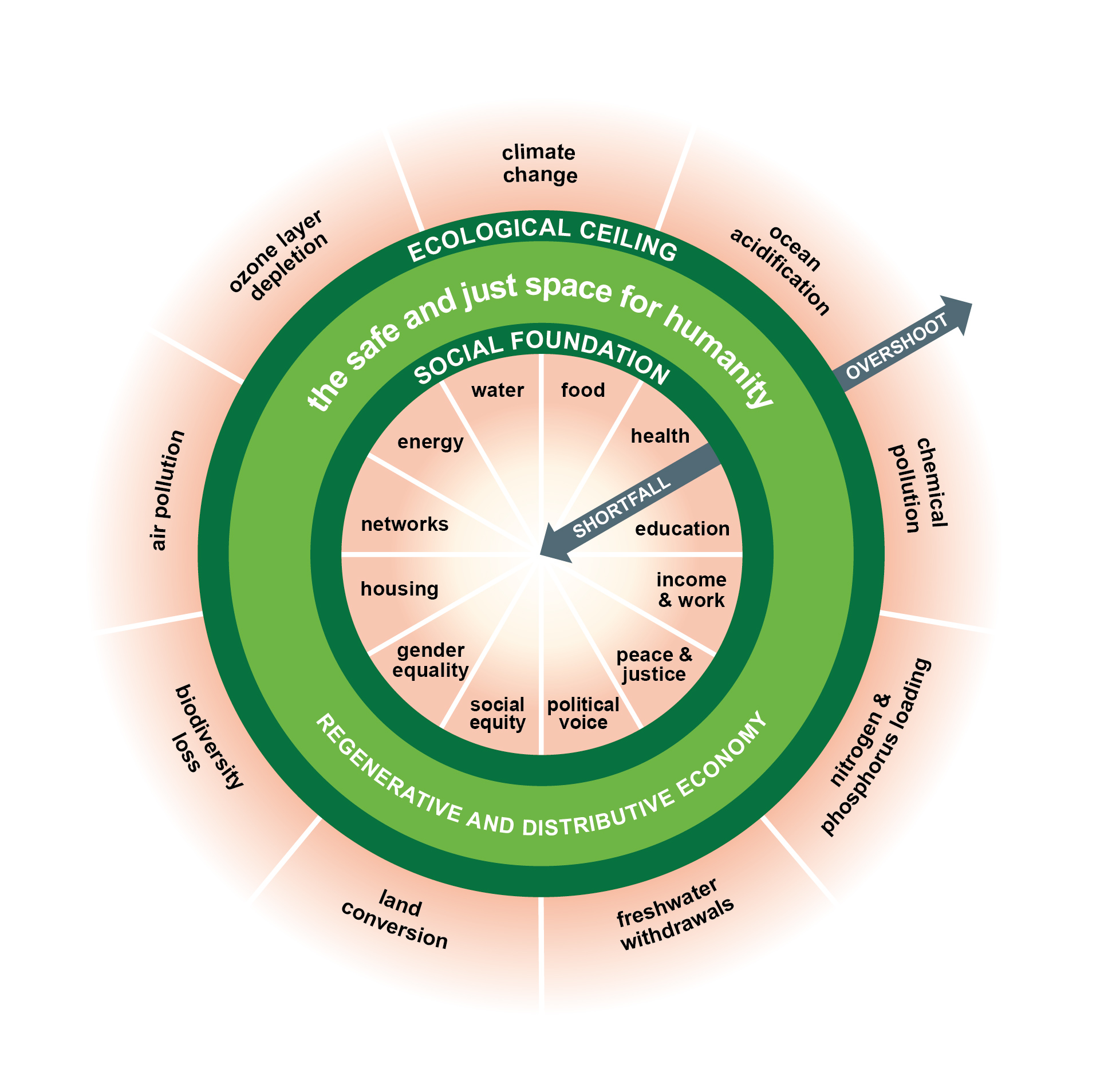

Kate Raworth created Doughnut Economics to guide us towards an economy where humanity can thrive in an environmentally safe and socially just space between social and planetary boundaries.

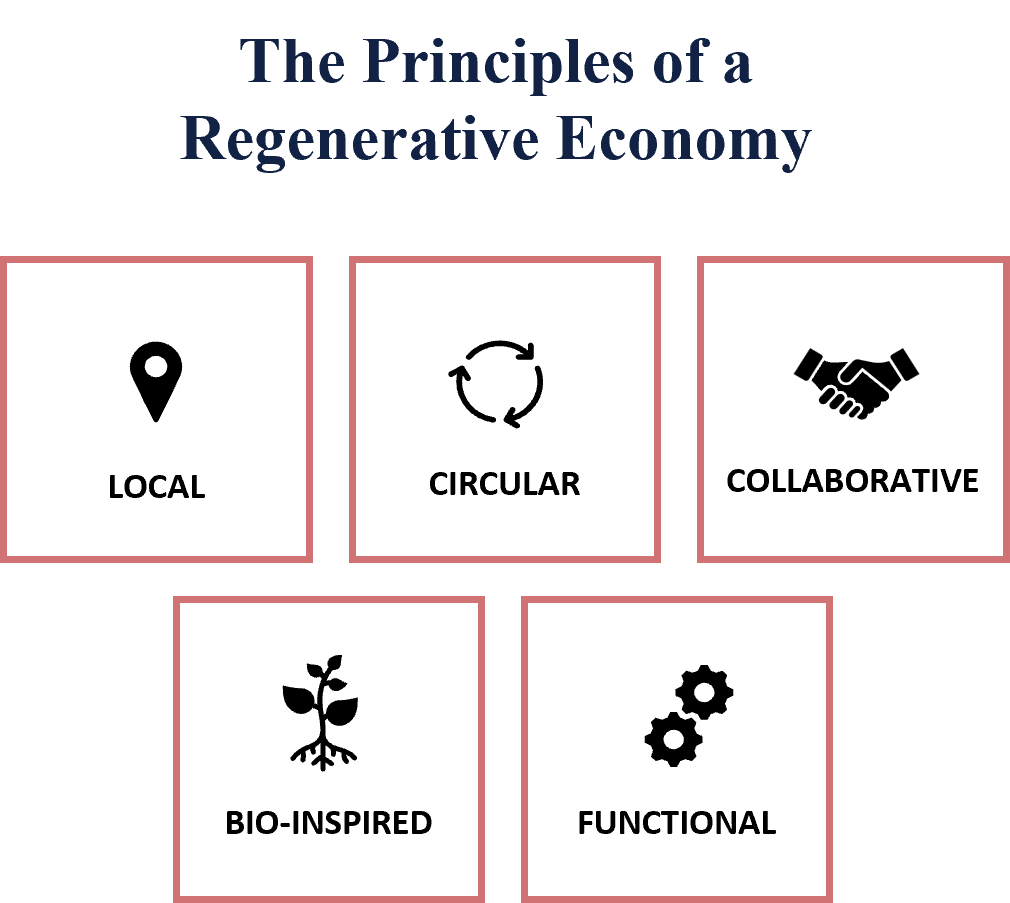

To remain in this environmentally safe and socially just space, a new economic model is needed, one that moves away from the Linear Economy to one that is Regenerative.

OUR MISSION

We enable financing to privately-held companies which, through their products and services, are implementing sustainable solutions and support them to advance the transition towards a Regenerative Economy, while generating attractive risk-adjusted returns for our investor clients

Consume better with less

Our clients invest in companies that aim to transform the food and consumer goods sectors through responsible consumption

Consume better with less

Our clients invest in companies that aim to transform the food and consumer goods sectors through responsible consumption

Use energy wisely

Our clients invest in companies that offer smart living solutions through decarbonized mobility, energy efficiency, energy supply & storage, and efficient buildings

Use energy wisely

Our clients invest in companies that offer smart living solutions through decarbonized mobility, energy efficiency, energy supply & storage, and efficient buildings

WHAT WE LOOK FOR

IMPACT VENTURE

IMPACT GROWTH

Stage: innovative start-ups requiring venture capital

Sectors: sustainable food providing solutions to the food transition

Financial criteria: post-revenue, proven product-market fit

Geography: France and/or Spain

Investment Tickets: between €100k and €500k

Stage: innovative companies requiring growth capital to continue trajectory

Sectors: sustainable food, responsible consumption, mobility, energy & housing

Financial Criteria: EBITDA positive or clear commercial track-record (min. EUR 4m revenues, strong growth) and pathway to profitability

Geography: Europe

Investment Tickets: between €4m and €15m

WHAT WE LOOK FOR

IMPACT VENTURE

Stage: innovative start-ups requiring venture capital

Sectors: sustainable food providing solutions to the food transition

Financial criteria: post-revenue, proven product-market fit

Geography: France and/or Spain

Investment Tickets: between €100k and €500k

IMPACT GROWTH

Stage: innovative companies requiring growth capital to continue trajectory

Sectors: sustainable food, responsible consumption, mobility, energy & housing

Financial Criteria: EBITDA positive or clear commercial track-record (min. EUR 4m revenues, strong growth) and pathway to profitability

Geography: Europe

Investment Tickets: between €4m and €15m

WHAT WE OFFER

12 Year Experience in

Impact Investing

Since 2010, we are continously improving our impact investing approach, offering our clients investment opportunities that are both profitable and transformative

Dedicated Team

Our team of 11 investment and impact specialists has a strong European footprint and network.

Integrated Impact

Investment Process

We have a structured investment process, fully integrated with our impact approach, from proactive sectoral origination to responsible exits.

Proprietary Impact Management Methodology

Our methodology is designed to support companies in transforming their practices to advance the transition towards a Regenerative Economy.